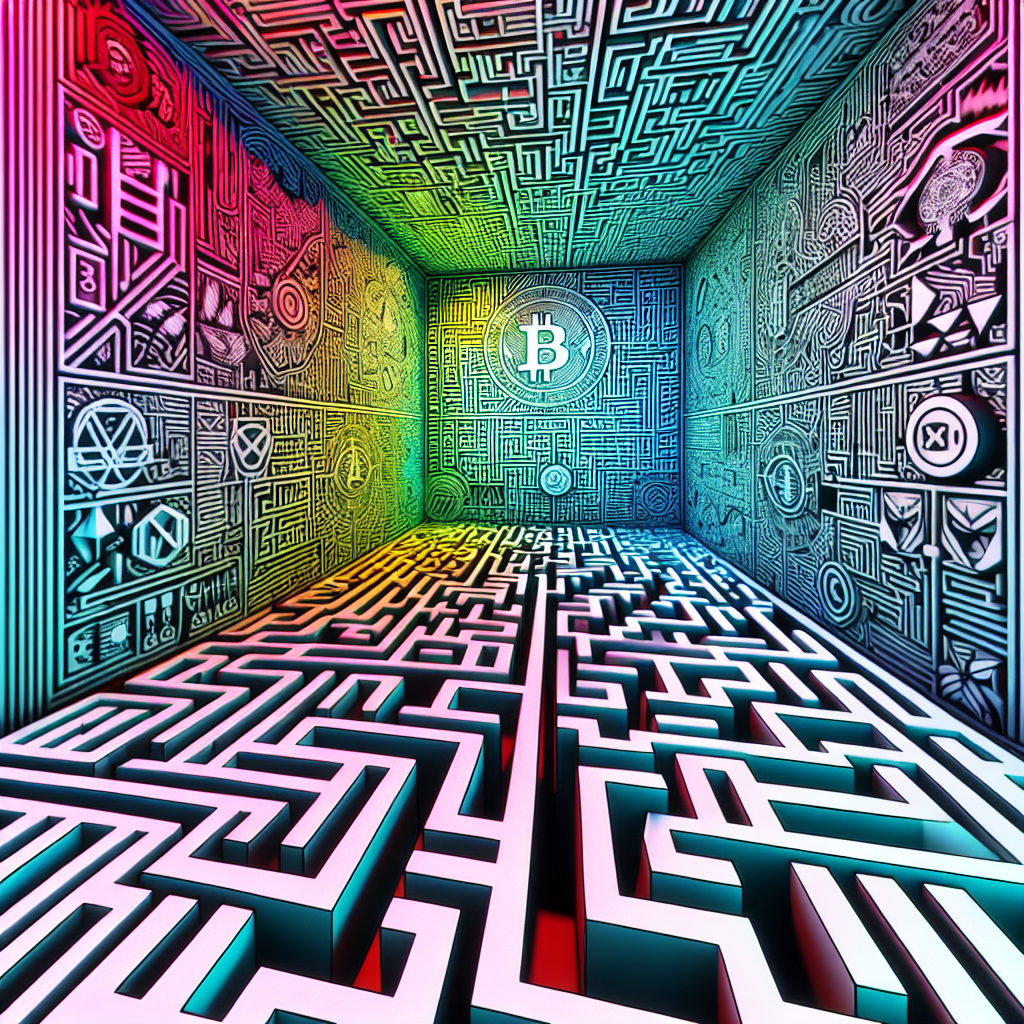

Navigating the Price Maze: Bitcoin and Cryptocurrencies Confined to a Corridor

The world of cryptocurrencies, with Bitcoin at its helm, is often likened to a labyrinth. The volatile nature of these digital assets, coupled with their complex underlying technology, can make navigating the crypto market a daunting task. This article aims to shed light on the current state of Bitcoin and other cryptocurrencies, particularly their confinement within a price corridor.

Understanding the Cryptocurrency Price Corridor

The price corridor of cryptocurrencies refers to the range within which the price of a particular cryptocurrency fluctuates. This range is determined by various factors, including market demand, investor sentiment, regulatory news, and technological developments. Understanding this price corridor is crucial for investors as it can provide insights into potential price movements and investment opportunities.

Bitcoin: The Flagship Cryptocurrency

As the first and most prominent cryptocurrency, Bitcoin often sets the tone for the rest of the market. Its price corridor is closely watched by investors and analysts alike. Over the past year, Bitcoin’s price has been confined to a corridor between $30,000 and $60,000, with occasional spikes and dips.

- Case Study: In April 2021, Bitcoin reached an all-time high of nearly $65,000, driven by increased institutional adoption and the listing of Coinbase on the NASDAQ. However, it soon fell back within its price corridor, highlighting the volatility and unpredictability of the crypto market.

The Impact of Market Factors on the Price Corridor

Various market factors can influence the price corridor of cryptocurrencies. For instance, regulatory news can cause significant price movements. Positive news, such as the acceptance of Bitcoin as legal tender in El Salvador, can push prices up, while negative news, such as China’s crackdown on crypto mining, can cause prices to plummet.

- Statistics: According to a study by the Cambridge Centre for Alternative Finance, China’s share of global Bitcoin mining fell from 75.5% in September 2019 to 46% in April 2021, largely due to regulatory pressures.

Investor Sentiment and Technological Developments

Investor sentiment and technological developments also play a significant role in shaping the price corridor. Positive sentiment, driven by factors such as increased adoption and technological advancements, can lead to price increases. Conversely, negative sentiment, often triggered by market crashes or technological setbacks, can lead to price decreases.

- Example: The introduction of Bitcoin futures in December 2017 led to a surge in Bitcoin’s price, pushing it to nearly $20,000. However, the subsequent crash in early 2018, partly due to technological issues and negative investor sentiment, saw Bitcoin’s price fall to around $3,000.

Conclusion: Navigating the Cryptocurrency Maze

Navigating the cryptocurrency market and its price corridor can be challenging, given its volatility and the myriad of factors influencing prices. However, by understanding these factors and keeping a close eye on market trends, investors can make informed decisions and potentially reap significant rewards.

As the crypto market continues to evolve, the price corridor of Bitcoin and other cryptocurrencies will likely shift. Therefore, staying updated with the latest market developments and regulatory news is crucial for successful navigation of the cryptocurrency maze.